Will Mortgage Rates Ever Go Back Down Again?

- hello52965

- Sep 5, 2023

- 3 min read

Updated: Sep 6, 2023

Why Okanagan Valley Buyers Should Get a Mortgage Despite Current Rates, While Letting Others Delay Building Real Estate Wealth

You’re itching to buy a home in the BC Okanagan Valley. Why wouldn’t you, given that it’s the best place to live in the province and country!? We know, you’re hesitating because the mortgage rates have been as high as they have been in a decade. Furthermore, the Bank of Canada’s incessant (and reactive) interest rate hikes and quantitively tightening isn’t doing anyone any favors. This is leading you and hundreds of other prospective buyers in the Valley to ask; will mortgage rates ever go back down again?

You’re not asking the right question.

Instead, we encourage you to ponder whether or not you should proceed to buy a home this summer of 2023, despite stubborn mortgage rates. The answer for those who learn how to “play the game” is YES. Here’s what you need to know.

High Interest Rates Expected to Last?

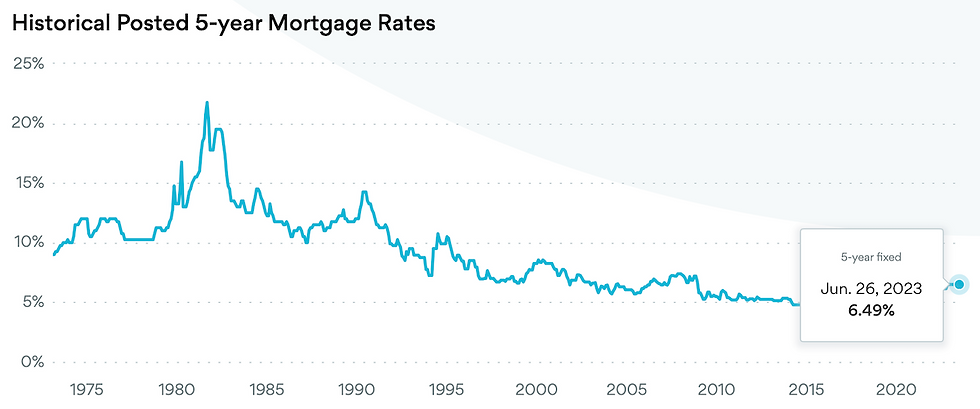

Let’s take a look at Canada’s historical values for posted rates as far back as 1973. Consider the state of the economy today, and consider how much higher the rates can actually go, noting the recession of 1981. While things won’t get as dire as they were in the 80s and early 90s (a great time for music, mind you) we are on a slow and steady upward trajectory at the moment. The best one can exact is a plateau of fixed and variable rates for the remainder of 2023 and even into 2024.

There’s really no point in delaying homeownership any longer. In fact, by waiting you could be kicking yourself at the same time next annum. At the very least, consider a short term fixed mortgage so that you can enjoy low-risk constancy while having the option to renew in one to three years from now.

Make a Smart Break if Rates do Drop

What is rates buck the trend, and actually drop significantly in 2024? No matter how unlikely that scenario is, we understand that you may want to have an option for an “out” should you commit to a mortgage today. Fair enough. While it’s never ideal, you do have the option to break a fixed rate mortgage. You have probably heard that doing so comes with significant penalties. It can, but when you have mortgage specialist broker the break, you can actually come out on top. Learn more about getting out of a 5-year fixed mortgage.

Take Your Pick of Properties

As our cheeky secondary heading above (...letting others delay building real estate wealth) indicates, let other buyers play the wait-and-see game. While they do, you will enjoy the pick of the litter when it comes to desirable properties in the enticing Okanagan Valley. Better yet, because rates are high and sales have plateaued to pre-pandemic levels, the prices of highly desirable properties have dropped. So not only do you get your pick of homes, you get lower prices than what trepidatious buyers will pay in a year from now, or longer. By acting now you get the last laugh. Enjoy it!

Here’s How to Make Mortgage Rates Drop Right Now

Will mortgage rates ever come back down again? For most buyers, probably not in the foreseeable future. But most buyers aren’t reading this. You are. As a result, you control your destiny and can make rates drop right now! How is this possible? By working with Carloni Mortgage Brokers.

Rene Carloni has long-established relationships with BC’s big banks in addition to alternative private lenders. The bulk of these lending institutions have provided bulk discounts on mortgage rates to our brokerage because we consistently send them business through the years. We pass these exclusive and discounted rates on to our clients (you).

Take the power away from the Bank of Canada and their reactive actions regarding the economy, which do nothing but harm individual households who want to build their own real estate wealth. All that you need to do it email or call Carloni Mortgage Brokers and we’ll take care of the rest. It really is that simple.

Comments